Microsoft Knew Windows 7 Upgrades Could Paralyze PC's Back In July

" The Bottom Line here is NEVER buy a Microsoft product until it has been on the market for at least a year. The Windows 7 upgrade cycle it is going so poorly, you may want to consider shorting Microsoft stock, since this upgrade cycle is turning into a disaster and taking the profits and buying a Macintosh. You can fool all the people some of the time, but you can't fool all of the people all of the time, something Bill Gates needs to learn" Willy Bova

Some people who are upgrading their PC's from Windows Vista to Windows 7 are finding the upgrade paralyzes their computers, leaving them in a never ending rebooting cycle, unable to use either operating systems.

Many users started to post the problem in a forum on Microsoft's own website on Friday, one day after the highly touted new operating system was released. As of this afternoon, 3 days later, there are still people posting the same problem and no fix from Microsoft for most of the users.....

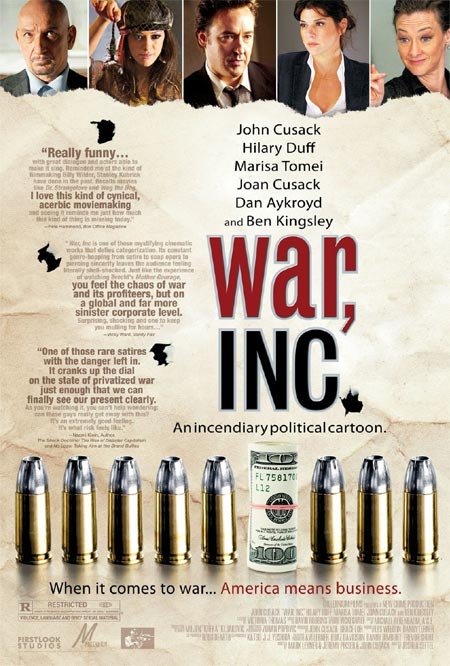

The Political Version of the Mac vs. PC Guy Ads

(Video, Very Funny)

The Democratic Senatorial Campaign Committee is out with a new political ad spoofing the now famous Apple advertisements. However, instead of "I'm a PC and I'm a Mac," it's now "I'm a Democrat and I'm a Republican."

Apple President calls Windows 7 an “Antiquated technology”

Brian Croll, vice president of Apple’s Mac OS X worldwide product marketing, has criticized Microsoft calling it an “Antiquated Technology”. The remarks comes at the same time as the release of Windows 7, according to Brian Croll Microsoft users were tired of the “headaches” caused by the Windows operating system, and he expects some disillusioned Windows users to switch to Apple’s Mac platform.

We think this is an opportune time for people to take a look at a Mac. We believe we can get even more people moving over.

Windows 7 is still just Windows. It doesn’t change a lot. It’s still complex, it’s still really expensive when you look at the cost of the upgrade, and there’s still security concerns It also still requires a lot of assembly. It turns out when you get Windows 7 it doesn’t even have some of the basic applications.....

How a Crashing Dollar Hides Trends

Many Americans have a hard time wrapping their mind around a declining currency or the hidden tax that is inflation. The U.S. Treasury and Federal Reserve understands this and for decades has exploited this issue to slowly siphon off the buying power of the U.S. dollar. Openly they tell the public that they are for a strong dollar policy but every action they take is guided to slowly debasing the currency. Take for example the current stock market rally. The Dow Jones Industrial Average is up 56 percent from the March lows. A stunning rally only seen one other time in history and we would need to go back to the 1930s for that. Yet at the same time, we have seen a collapse in the U.S. dollar. That is why oil, even though demand is relatively the same, is now back near $80 a barrel.

The Federal Reserve can easily strengthen the U.S. dollar. All they would need to do is increase interest rates to reign in liquidity. Yet this would crush the debt consumption in housing and autos. To show you the insidious way how the value of the currency is being washed away, take a look at the recent Dow rally in terms of Euros, a more stable currency:

What Do You Call Finding Ponzi Scum Bernie Madooff's $5 Billion Partner Jeffery Picower Dead at the Bottom of a Pool?.... A Good Start?...

Florida investor and philanthropist Jeffry Picower, accused of making billions of dollars in his friend Bernard Madoff's fraud scheme, died Sunday after he was found at the bottom of his swimming pool, police said.....

The court-appointed trustee tracking down Madoff's missing billions has sued Picower to recoup part of the 6.7 billion dollars he and his associates were said to have withdrawn from the scheme orchestrated by Madoff, whom court papers said was a friend and associate of Picower for more than 20 years.

"The trustee's investigation to date has revealed that at least five billion dollars of this amount was fictitious profit from the Ponzi scheme," according to the documents filed in May to the US bankruptcy court in Manhattan. Picower, a former lawyer and accountant who reportedly once came under scrutiny by the Internal Revenue Service for his work with suspicious tax shelters, was accused of knowingly profiting from the Madoff fraud which brought "implausibly high rates of return," according to the filings

Picower's annual return rates often topped 100 percent, with one account in 1999 yielding a return of 950 percent, the documents said. In the filings, trustee Irving Picard said Picower enjoyed "an unusually close relationship with Madoff" and was given special access to information and dealings of Madoff's investment company....

Madoff Twist: The Big Winner You've Never Heard of Jeffery Picower

It is rare these days to see Bernard Madoff's name in print unaccompanied by the word "Ponzi." Yet recent allegations raise the possibility of one key difference between Madoff's crimes and those of legendary con artist Charles Ponzi. While Ponzi's scam was under way, Ponzi himself was its biggest beneficiary. It now appears that the biggest winner in Madoff's scheme may not have been Madoff at all, but a secretive businessman named Jeffry Picower.

Between December 1995 and December 2008, Picower and his family withdrew from their various Madoff accounts $5.1 billion more than they invested with the self-confessed swindler, according to a lawsuit filed by the trustee who is trying to recover money for those Madoff defrauded....

"Michael Moore's Action Plan: 15 Things Every American Can Do Right Now"

2. Congress must join the civilized world and expand Medicare For All Americans. A single, nonprofit source must run a universal health care system that covers everyone. Medical bills are now the #1 cause of bankruptcies and evictions in this country. Medicare For All will end this misery. The bill to make this happen is H.R. 3200 -- but this bill is worthless without the amendment from Rep. Anthony Weiner that will bring us closer to the real bill that should be passed: H.R. 676. You must call AND write your members of Congress and demand that they support this amendment, no compromises allowed.

4. Each of the 50 states must create a state-owned public bank like they have in North Dakota. Then congress MUST reinstate all the strict pre-Reagan regulations on all commercial banks, investment firms, insurance companies -- and all the other industries that have been savaged by deregulation: Airlines, the food industry, pharmaceutical companies -- you name it. If a company's primary motive to exist is to make a profit, then it needs a set of stringent rules to live by -- and the first rule is "Do no harm." The second rule: The question must always be asked -- "Is this for the common good?" (Click here for some info about the state-owned Bank of North Dakota.)

1. Take your money out of your bank if it took bailout money and place it in a locally-owned bank or, preferably, a credit union.

2. Get rid of all your credit cards but one -- the kind where you have to pay up at the end of the month or you lose your card.

3. Do not invest in the stock market. If you have any extra cash, put it away in a savings account or, if you can, pay down on your mortgage so you can own your home as soon as possible. You can also buy very safe government savings bonds or T-bills. Or just buy your mother some flowers....

Apple: 'Windows 7 is antiquated technology'

(See Story Below)

The criticism comes from Brian Croll, vice president of Apple's Mac OS X worldwide product marketing. He said that Microsoft users were tired of the "headaches" caused by the Windows operating system, and expects some disillusioned Windows users to switch to Apple's Mac platform.

"Windows users are really tired of all the headaches that they've been getting over the years, starting all the way back from Windows Me to NT to Vista and now Windows 7," he said. "As a result, I think people are looking for something different, and the Mac offers real ease of use, stability and security."

Windows 7 Demonstration on Live TV Freezes Repeatedly, Needs Reboot

(Nice to See Windows 7 Should be as reliable as Vista)

Goldman Sachs Says People Must learn to Live with Pay Inequality. MSNBC Anchor urges Americans to withdrawl Their Money from Large Banks (Video)

I’m surprised this isn’t a bigger story, though perhaps it hasn’t yet migrated from England to the US. The vice-chairman of Goldman Sachs International, Lord Griffiths (and doesn’t it just fit that he’s a lord), said yesterday in London at conference on “morality and markets” (!) that the public most learn to tolerate inequality as the price to be paid for prosperity, a stunning quote given recent events in the global financial markets....

Waiting for the Next McMansion to Drop

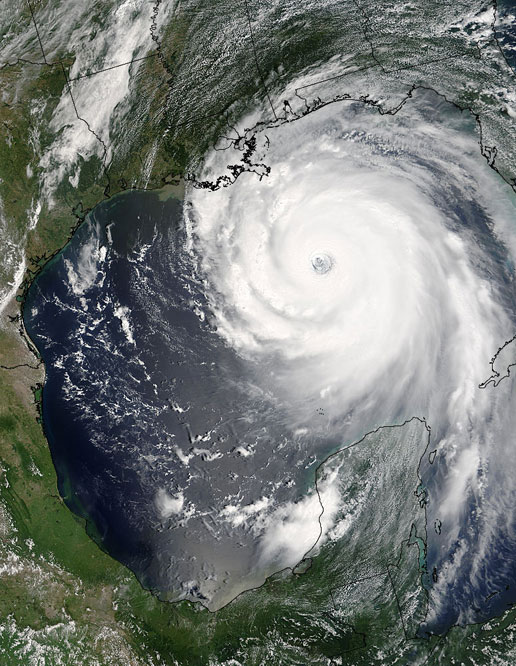

Despite some tentative signs of recovery, the U.S. housing market remains vulnerable to further price drops—especially in areas where large numbers of mortgages are headed toward foreclosure over the next few years.

The Wall Street Journal's quarterly survey of housing-market data in 28 major metro areas shows sharp drops in the number of homes listed for sale across the country. But the potential supply of homes is far larger because banks are likely to acquire significant numbers of foreclosed homes in some areas, notably Las Vegas, Atlanta, Detroit, Phoenix, Miami and other parts of Florida, and Sacramento, Calif., over the next few years.....

Did Paulson’s secret meeting with Goldman Sachs break the law?

When Henry Paulon left his position as CEO of investment bank Goldman Sachs in 2006 to become George W. Bush's Secretary of the Treasury, he signed an ethics letter promising to avoid conflicts of interest by not getting involved in any dealings with his former firm.

Paulson received a secret waver of that promise at the height of the financial crisis last year -- but a new book by New York Times columnist Andrew Ross Sorkin reveals that Paulson had already met secretly with the Goldman Sachs board of directors in June 2008, after the collapse of Bear Stearns but three months before the waiver. The meeting took place in Moscow, where Paulson had gone in an unsuccessful attempt to seek Russian investment in the US economy....

Change We Can Believe in: Ex Bush Nomminee to Head Homeland Security Department Bernir Kerik Jailed Without Bail, Awaiting Corruption Charges

An angry federal judge sent former New York City Police Commissioner Bernard Kerik to jail Tuesday for sharing secret pretrial information with a "propagandist" who Kerik claimed was really his lawyer. Kerik will be forced to await his upcoming corruption trial behind bars. Judge Stephen Robinson found probable cause to believe he was in contempt of Court....

Bush Secretary Of Treasury Paulson Met With Goldman Sachs Board of Directors in Secrert in Moscow Before the Finacial Collapse

(Hank Paulson Belongs in the Jail Cell Next to Bernie Kerik)

During that long summer between the collapse of Bear Stearns and the collapse of Lehman Brothers, Hank Paulson held a secret meeting with the board of Goldman Sachs in Moscow....

Anxious about the prospect of such a meeting, Wilkinson called to get approval from Treasury’s general counsel. Bob Hoyt, who wasn’t enamored of the “optics” of such a meeting, said that as long as it remained a “social event,” it wouldn’t run afoul of the ethics guidelines.

Still, Wilkinson had told [Goldman chief of staff John] Rogers, “Let’s keep this quiet,” as the two coordinated the details. They agreed that Goldman’s directors would join him in his hotel suite following their dinner with Gorbachev. Paulson would not record the “social event” on his official calendar…

“Come on in,” a buoyant Paulson said as he greeted everyone, shaking hands and giving bear hugs to some.

For the next hour, Paulson regaled his old friends with stories about his time in Treasury and his prognostications about the economy. They questioned him about the possibility of another bank blowing up, like Lehman, and he talked about the need for the government to have the power to wind down troubled firms, offering a preview of his upcoming speech.

Felix Salmon has the appropriate reaction:

How on earth did Paulson think this was OK? Goldman Sachs was a hugely powerful for-profit investment bank, and there he is, giving private chapter and verse on his opinions about the US and global economy, talking about internal Treasury matters, and previewing an upcoming (and surely market-moving) speech. All in secret, at a “social event” which somehow got kept off his official calendar. Oh, yes, and one other thing — the whole shebang took place in the Moscow Marriott Grand Hotel, in the context of Goldman directors joking about how all the Moscow hotels were surely bugged.

This is sleazy in the extreme, and will only serve to heighten suspicions that Paulson’s Treasury was rigging the game in favor of Goldman all along.

You might recall that trip to Russia. It was a disaster. Paulson had gone to encourage Russian investment in the US economy, which was rapidly sliding into a recession. He wound up just being mocked by Russian officials.....

Internet use 'may improve brain function in adults', says UCLA study

(Perhaps not watching Propaganda on the Idioit Box is Good for the Brain?)

Using the internet for just a few days alters our brains – and may help improve cognitive function in the elderly, according to new research....

Cold War Remnant: Cancer for Baby Boomers

Even with a half-century's hindsight, the U.S. government's willingness to risk the health of the nation's children seems somewhere between unfathomable and unconscionable.

Between 1951 and 1962, the Atomic Energy Commission detonated more than 100 nuclear bombs in the atmosphere over its Nevada Test Site, just 65 miles from Las Vegas. The radioactive fallout menaced not only the ranchers and the miners unlucky enough to live in that remote area of southern Nevada, but -- as a new study unveiled Tuesday demonstrated -- untold millions of unsuspecting Americans as well.....

High-Fructose Corn Syrup Produces Toxic Chemical "HMF" When Heated

(NaturalNews) If you know anything about the food supply, you know that honey bees are a crucial part of the food production chain. In the United States, they pollinate roughly one-third of all the crops we eat, and without them, we'd be facing a disastrous collapse in viable food production.

That's why, when honey bees started to disappear a few years ago, scientists scrambled to find the root cause of the phenomenon, which has since been dubbed "Colony Collapse Disorder."

The name is a bit of a misnomer, though. It's not really a "disorder." It's more of a poisoning. Or at least that's what we may be learning from new research that's just been published in the ACS' Journal of Agricultural and Food Chemistry (http://pubs.acs.org/stoken/presspac...).

It's been difficult, of course, trying to determine the cause of colony collapse disorder. Some of the suggested theories for explaining the phenomenon included chemical contamination from pesticides, genetic contamination from genetically modified crops, changes in the Earth's magnetic field, climate change and air pollution. In an attempt to nail down some scientific answers, researchers from the USDA Agricultural Research Service in Tucson, Arizona joined with other researchers in New Orleans and the University of Wisconsin to check out another possible culprit: High-fructose corn syrup (HFCS).....

General Powell warned of ‘terror-industrial complex’ in 2007 interview

(Video)

When MSNBC's Keith Olbermann welcomed three former members of Monty Python to Countdown on Wednesday, his biggest surprise was a question from Terry Gilliam, "How come that Colin Powell interview about the terror-industrial complex didn't become a bigger story?"

Olbermann was taken aback by the question, but by the next day he had uncovered Powell's September 12, 2007 interview with GQ Magazine. Powell's apology in that interview for his use of faulty intelligence prior to the Iraq War grabbed the headlines at the time, but he also delivered a far less-noticed warning against what Olbermann now calls "an entire aspect of the nexus of politics and terror."

"What is the greatest threat facing us now?" Powell asked. "People will say it’s terrorism. But are there any terrorists in the world who can change the American way of life or our political system? No. ... The only thing that can really destroy us is us. We shouldn’t do it to ourselves, and we shouldn’t use fear for political purposes—scaring people to death so they will vote for you, or scaring people to death so that we create a terror-industrial complex."...

Spying on Americans: The Bipartisan National Security State

The bipartisan consensus that encourages unaccountable secret state agencies to illegally spy on the American people under color of a limitless, and highly profitable, "war on terror" was dealt a (minor) blow October 13.

Federal District Court Judge Jeffrey White denied a motion by the Obama administration that the court issue a 30-day stay to "release records relating to telecom lobbying over last year's debate over immunity for corporate participation in government spying," the Electronic Frontier Foundation reported.

The Justice Department had argued that the Bush, and now, the Obama administration's Office of Director of National Intelligence (ODNI) and Congress were exempt from releasing lobbying records under the Freedom of Information Act, since consultations amongst said grifters were protected as "intra-agency" records.

One might add, since the 2001 terrorist attacks on New York and Washington, a well-funded surveillance-industrial-complex fueled by giant defense firms and the telecommunications industry have, as investigative journalist Tim Shorrock reported back in 2005 "fielded armies of lobbyists to keep the money flowing.".....

Exclusive: U.S. Spies Buy Stake in Firm That Monitors Blogs, Tweets

America’s spy agencies want to read your blog posts, keep track of your Twitter updates — even check out your book reviews on Amazon.

In-Q-Tel, the investment arm of the CIA and the wider intelligence community, is putting cash into Visible Technologies, a software firm that specializes in monitoring social media. It’s part of a larger movement within the spy services to get better at using ”open source intelligence” — information that’s publicly available, but often hidden in the flood of TV shows, newspaper articles, blog posts, online videos and radio reports generated every day....

CIA To Monitor Internet Chatter For Anti-Government Sentiment

In the 2005 movie V For Vendetta, a film about a totalitarian society ruled by a fascist government with an iron surveillance fist, there’s a scene where state spooks drive down a residential street with a gadget that records the conversations people are having inside their homes and gives them a rating on how antagonistic towards the authorities they are.

A frighteningly similar scenario is now on the horizon with the news that the CIA’s investment arm In-Q-Tel is putting cash into Visible Technologies, a company that monitors the output of social media, in order to “Read your blog posts, keep track of your Twitter updates — even check out your book reviews on Amazon,” reports Wired News....

High-speed chase ends when OnStar halts stolen SUV

When two Visalia, Calif., police officers swung their cruisers behind a sport utility vehicle that had been carjacked at gunpoint early Sunday, they prepared for a dangerous high-speed chase. The 2009 Chevrolet Tahoe roared away with officers in pursuit, but shortly after the suspect made a right turn, operators at General Motors Co.'s OnStar service sent a command that electronically disabled the gas pedal and the SUV gradually came to a halt....

Eighty Years After the Great Crash -- 'Is It the '30s Again?'

Markets and the economy look less cataclysmic than they did earlier this year. And so they should, following a torrent of monetary easing.

But that doesn't mean happy days are here again. If you want a second opinion, don't look at the Dow Jones Industrial Average. Look at three other markets: bonds, gold and the dollar. All of them are flashing amber, or red.

Take the bond market: Yields on U.S. Treasurys have collapsed to historic lows. The 30-year bond is yielding just over 4.2%, well below long-term averages. This is usually a strong signal of tougher times ahead. It's almost impossible to reconcile this with the stock market's sunny vision of a swift economic rebound.

Meanwhile, the dollar has been slumping on world markets. It has been the cornerstone of the global economy for nearly a century, but is quickly losing its credibility. No wonder gold, in its stead, has been surging to new highs....

Republicans Are Irrelevant to Health Care Reform

Sen. Olympia Snowe (R-Maine) voted for the weakest of the five health care bills passed by Congressional committees. Big deal. If the bill that goes to the Senate floor is weak enough for her to vote for, then the insurance companies will win and the American people will lose.

When Sen. Harry Reid (D-Nevada) emerges from private meetings with Sen. Christopher Dodd (D-Connecticut), Sen. Max Baucus (D-Montana) and Obama administration officials, led by chief of staff Rahm Emanuel, the bill needs to have a strong public option or the insurance companies will carry out their threat to raise everyone's premiums, leading to an angry electorate in 2010.

Democrats can cry foul all they want when the insurance industry threatens to raise rates, but if the final bill looks like the Finance Committee bill, higher premiums are inevitable...

Real Estate Collapse Entering New Phase: Banks Refusing to Repossess Abandoned Homes, or Even File Foreclosures

Via Cryptogon:

Not only are there no bids in some markets, the accumulation of property taxes means that some properties have negative valuations, like a derivative trade that’s gone bad.

Via: Dayton Daily News:

Nobody is sure exactly how many bank walkaways are occurring. For various reasons, they can’t be identified in searches of public real estate and court data without individually pulling case files, experts say.

But nobody questions that they are on the increase.

David Rothstein, a researcher with Policy Matters Ohio, summarized the way they occur like this:

* The lender files a foreclosure, gets the foreclosure judgment in court, takes the property to sheriff’s auction but doesn’t bid on it if no one else does.

* The lender files as above, gets the judgment, sets the sheriff’s auction, then cancels the sale at the last minute.

* The lender files as above but then never requests a sheriff’s auction.

* The lender doesn’t even bother to file foreclosure.

All of these actions leave the foreclosed property in the hands of the original owner who, in many cases, has moved out and is unaware the lender hasn’t taken it....

Browsing the "Net" Can Save Off Dementia

Want to stave off dementia? Browse the web, for a new study says that using the Internet can help boost brain power in people as they age. An international team has carried out the study and found that Internet use can boost the brain activity of the elderly, potentially slowing or even reversing the age-related declines that can end in dementia. The study has found that the Internet stimulates mind more strongly than reading and its effects continue long after an web session ends....

Canadian Dollar Climbs Toward Parity as Stocks, Crude Oil Rally

The Canadian dollar rallied for a third straight week, touching a 14-month high and moving closer to parity with its U.S. counterpart as signs of economic recovery pushed commodities and stocks higher....

Harper Says Canadian Dollar Strength Is a Concern

Canadian Prime Minister Stephen Harper reiterated today he shares Bank of Canada Governor Mark Carney’s concern that the recent gain in the country’s currency could slow the rebound from a recession. Carney “has been very clear about his concerns on the dollar and the possible effects it could have in terms of slowing the recovery,” Harper told reporters in Toronto today. “I share his concerns.”...

Dollar May Drop 20% More, Harvard’s Ferguson Says

(See Story Below, Harvard lost $500,000,000 Betting the wrong way on interest rates, Perhaps Harvard is short the US Dollar, and is trying to push the Dollar Down?)

The dollar will extend its drop versus the euro over the next two to five years, falling as much as 20 percent to an all-time low under a widening U.S. budget deficit, Harvard University’s Professor Niall Ferguson said....

Harvard’s Bet on Interest Rate Rise Cost $500 Million to Exit

Harvard University’s failed bet that interest rates would rise cost the world’s richest school at least $500 million in payments to escape derivatives that backfired.

Harvard paid $497.6 million to investment banks during the fiscal year ended June 30 to get out of $1.1 billion of interest-rate swaps intended to hedge variable-rate debt for capital projects, the school’s annual report said. The university in Cambridge, Massachusetts, said it also agreed to pay $425 million over 30 to 40 years to offset an additional $764 million in swaps....\

NY Times: Is the CIA still hiding JFK assassination secrets?

The CIA is fighting to prevent the release of hundreds of documents involving its funding of an anti-Castro group in New Orleans that engaged in well-publicized clashes with Lee Harvey Oswald in the summer of 1963.

The New York Times reported on Friday that the files "involve the curious career of George E. Joannides, the case officer who oversaw the dissident Cubans in 1963. In 1978, the agency made Mr. Joannides the liaison to the House Select Committee on Assassinations -- but never told the committee of his earlier role."

Joannides was the deputy director for psychological warfare at the CIA's Miami station, JM/WAVE, which was the center of anti-Castro activities in the early 60's and served as a spawning ground for figures who would later be involved in covert operations in Vietnam and in Iran-Contra....

"Nothing to see here folks move along, just because the man the CIA made the liaison to the House Select Committee on Assassinations was involved with Lee Harvey Oswald before the Assassination, and with the Miami JM/WAVE Operations, that have been long rumored to have provided the shooters for the assassinations, does not mean nearly 50 years later that we should declassify information about Mr Joanndides, move along the show is over, nothing to see here..." Willy Bova

The Jim Garrison Tapes from 1993 about JFK Coup, (Must see Video)

The Last Confessions of E. Howard Hunt

He was the ultimate keeper of secrets, lurking in the shadows of American history. He toppled banana republics, planned the Bay of Pigs invasion and led the Watergate break-in. Now he would reveal what he'd always kept hidden: who killed JFK..

Farewell America

The following work by the pseudonymous "James Hepburn" is largely accepted to be authored by French Intelligence (Their equivalent to our CIA) as the "real" story behind the Kennedy assassination. Originally published in 1968 it remained unpublished in the United States for many years. With the advent of the Internet and the information explosion, it is now freely available. It describes the most probable players and conspirators in the terrible assassination of the beloved Kennedy - The military intelligence set; the oil and arms industrialists; Religious zelots and organized crime are all here and in the background the ever looming shadow the maltese cross of the secret religious orders. It's the compelling facts. As for the "Official" goverment version of the Kennedy assassination - we all know what that's worth.

Chapter 14 The Secret Service

The Secret Service was guilty of negligence, as the highly respected Wall Street Journal commented. But its agents were professionals, and they recognized the work of other professionals. They were the first in the President's entourage to realize that the assassination was a well organized plot. They discussed it among themselves at Parkland Hospital and later during the plane ride back to Washington. They mentioned it in their personal reports to Secret Service Chief James Rowley that night. Ten hours after the assassination, Rowley knew that there had been three gunmen, and perhaps four, at Dallas that day, and later on the telephone Jerry Behn remarked to Forrest Sorrels (head of the Dallas Secret Service), "It's a plot." "Of course," was Sorrel's reply. Robert Kennedy, who had already interrogated Kellerman, learned that evening from Rowley that the Secret Service believed the President had been the victim of a powerful organization....

"Chapter 13 The Committee, Chapter 11 Texans, Chapter 10 Oilmen, etc... It is a slow news weekend ballon boy and all, give this a read sometimes it is an eye opener....' Willy Bova

ANOTHER INSULT FROM BUSH AND THE PENTAGON NEO-CONs

By Wayne Madsen

2004 Washington, DC - November 22 still has meaning for me. Although I was in elementary school on this day in 1963, I vividly remember the shock and horror of a nation that experienced the brutal murder of its young and popular president on a Dallas street. But November 22 apparently no longer means much to either George W. Bush or his neo-con cabal who are currently consolidating their dominance over the Pentagon and setting their sights on the CIA and State Department...

Micheal Moore: Banks rewarded for ‘burning down our economy' (Video)

As the Dow Jones Industrial Average celebrates its triumphant return to 10,000 and Wall Street's infamous, massive bonuses return, The Los Angeles Times was left wondering Thursday morning: "Where's the outrage?"

As if to answer their question, filmmaker Michael Moore made an appearance on NBC's Today Show, explaining to interviewer Matt Lauer that such numbers are echoing from America's financial sector because bankers are being rewarded for "burning down our economy."

"Michael, let me make sure people understand this," began Lauer. "A Wall Street Journal report says that Wall Street firms are going to pay out about $140 billion in bonuses this year. A year before the economic meltdown, 2007, they paid out about $130 billion. So, it's gone up. How's this news going to go over with people like in your home state, Michigan, that just found out unemployment is at 15.3 percent in that state?"..."Eventually, people aren't going to take it," Moore deadpanned. "I don't know how many gated communities these people -- who are taking this $140 billion in bonuses -- I don't know how many castles with moats around them they can build, but I'll tell ya something. There's an anger that's building out there....

Bank of America recieved $20 billion in bailout money

and Paid out $15 Billion in Bonuses

...In January of this year, consumer's rights advocates were dismayed to discover that BofA had used some 75 percent of a $20-billion bailout installment to pay bonuses to executives at Merrill Lynch, the brokerage BofA purchased in 2008.

"All Americans should withdrawl their money from Bank of America, that should solve the problem..." Willy Bova

US pays $400 per gallon for gas in Afghanistan

Last year, the price of gasoline in the United States topped the $4 per gallon mark.

This year in Afghanistan, the price has topped $400.

The stunning revelation emerged Thursday in a report by the Congressional Research Service, an arm of Congress that conducts non-partisan evaluations of projects and programs. The report says that part of the reason it costs so much to keep US forces in Afghanistan, is because the government is paying $400 per gallon of fuel....

The 5 Corporations Ruining America

1. Walmart

Walmart’s entire business plan consists of growing their locations to the point where it is the only place that people can shop and they didn’t get to be the single biggest corporation in the world by not meeting their goals.

Consider the upside. Soon we will all be able to buy our guns, milk, the full series collection of “Dukes of Hazard,” and XXL sweatpants in the same location, and feel moral about buying useless crap in a moral environment that does not expose us to the dangers of magazines like Maxim and FHM, music with offensive lyrics, and Superbad. Thank you Walmart.

The great thing is that it wont end there. As the sole retailer in the country, Walmart will be the only place we will be able to purchase cars (only American, of course), books (imagine what three aisles of nothing but the Bible and Ann Coulter books), and birth control (sorry, permanently sold out).

I for one welcome our future retail overlords. We should all be told what we should and shouldn’t buy by the store we’re shopping in.....

The pocket spy: Will your smartphone rat you out?

.....These changes could well be exploited in much the same way that email and the internet can be used to "phish" for personal information such as bank details. Indeed, some phone-related scams are already emerging, including one that uses reprogrammed cellphones to intercept passwords for other people's online bank accounts. "Mobile phones are becoming a bigger part of our lives," says Andy Jones, head of information security research at British Telecommunications. "We trust and rely on them more. And as we rely on them more, the potential for fraud has got to increase."

So just how secure is the data we store on our phones? If we are starting to use them as combined diaries and wallets, what happens if we lose them or they are stolen? And what if we simply trade in our phones for recycling?.....

Jon Stewart: GOP protects Halliburton’s ‘it’s okay if you get raped’ clause (Video)

Following the widely publicized case of a KBR employee in Iraq who was gang-raped by her coworkers, Senator Al Franken (D-MN) proposed an amendment that would prevent federal contracts from going to companies like Halliburton/KBR that make employees waive the right to sue their employer if they are raped on the job.

"The old 'it's okay if you get raped' clause," The Daily Show's Jon Stewart commented sarcastically. "If ever there was a time for the unanimous passing of an amendment, the Franken Anti-Government Contractor Rape Liability bill would seem to be that." And yet 30 Republican senators voted against the amendment....

DOW 10,000!!!! Oh Wait, Make That 7,537

Another great representation of the amazing loss of purchasing power by the US public are today's oblivious statements about the Dow at 10,000. While in absolute terms the Dow may cross whatever the Fed thinks is a necessary and sufficient mark before QE begins to taper off (Dow crosses 10k just as Treasury purchases expire), the truth is that over the past 10 years (the first time the DJIA was at 10,000) the dollar has lost 25% of its value. Therefore, we present the Dow over the last decade indexed for the DXY, which has dropped from 100 to about 75. On a real basis (not nominal) the Dow at 10,000 ten years ago is equivalent to 7,537 today! In other words, not only have we had a lost decade for all those who focus on the absolute flatness of the DJIA, but it is also a decade where the US Consumer has lost 25% of purchasing power from the perspective of stocks! You won't hear this fact on the MSM.....

Gold hits record highs as dollar slides (40% vrs CAD this year so far)

Spot gold and futures hit record highs on Wednesday as the dollar extended losses to a 14-month low against a basket of currencies on growing optimism about the global economy.....

Saudis want US to pay for reducing oil usage

If you thought the executives at Goldman Sachs were the kings of backroom finance, think again.

Goldman Sachs, meet Saudi King Abdullah.

A new gambit by the oil-dealing kingdom would have Western oil guzzlers paying for using less oil. Sounds like the opposite of reality, you say? The Saudis say it's the only way they'll be able to afford helping the fight against global warming. The New York Times frames the Saudi idea as, "if wealthy countries reduce their oil consumption to combat global warming, they should pay compensation to oil producers."...

Microsoft ERASES T-MOBILE Customers Photos, Contacts and other Data Remotely by "Accident" On their "Smart Phones"

Not so smart after all. Microsoft and T-Mobile executives have been humiliated by their Sidekick smartphone, which first lost internet access and then deleted its customers' numbers, photos and other important data.

The two companies had to apologise yesterday after data held on customers' Sidekick phones was lost as a result of a server failure. As well as being hugely embarrassing, the failure will undermine confidence in "cloud computing", which many in the technology sector believe is set to be the next big development....

" I Think I will stick with my iPhone, and short Microsoft stock. It is amazing that people still buy anything made by those clowns at Microsoft....What kind of a Moron would design a phone that can remotely access and Delete the phone OWNERS Data, and what kind of an Idioit would buy a phone with those capabilities? What does Microsoft do with all your Contact information, photos and other data? Is it spelled out in the user agreement what happens to your information or is it just passed on to the NSA Outer-NET database?" Willy Bova

Health Insurers Threaten Rate Hikes

Though looking forward to millions of new customers who would be compelled by the U.S. government to buy health insurance, the insurance industry is threatening to raise premiums across the board if more of its demands are not met.

Industry representatives put Congress and the Obama administration on notice that if health-reform legislation doesn’t send even more new customers the industry’s way or if a windfall profits tax is included, the industry would hit businesses, individuals and the government with higher premiums, effectively defeating one of the initiative’s top goals, reining in ever-rising costs.....